Data is one of the most valuable assets a community bank or credit union has, yet many institutions struggle to make the most of it. Misconceptions about the cost, complexity, and necessity of data analytics can hold institutions back from tapping into their full potential.

But here’s the truth: understanding your customer data doesn’t have to be overwhelming or expensive. In fact, it can be the key to driving engagement, improving customer relationships, and making smarter business decisions.

So, grab your safety goggles and let’s bust some of the biggest myths surrounding data analytics—MythBusters style!

Myth #1: “I Know My Customers Like the Back of My Hand. I Don’t Need Analytics.”

Sounds familiar? This myth is as persistent as one of Jamie Hyneman’s signature berets. The truth? Just because you think you know your customers doesn’t mean you have the full picture.

We’ve tested this one: ask two executives from the same bank who their customer is, and you’ll often get wildly different answers. Why? Because those answers are based on personal interactions, not data.

Sure, you might know some of your regulars, but do you know how they compare to customers at other branches? Or which demographics, financial behaviors, and spending patterns make up the bulk of your customer base?

Data moves you from guessing who your customers are to knowing who they are. Analytics shine a light on trends, patterns, and customer segments you never even considered. And that knowledge is pure gold when it comes to tailoring your marketing and improving your ROI.

Verdict: Busted!

Personal experience is valuable, but data-backed insights are essential for precision messaging and consistent engagement.

Myth #2: “Customer Analytics Cost Too Much for a Financial Institution My Size.”

This myth is like trying to blow up a cement truck with dynamite—it just doesn’t hold up under scrutiny.

Here’s the truth: you don’t need a Silicon Valley-sized budget to unlock the power of data. Affordable customer analytics solutions are available, and many service providers offer tools tailored to small and mid-sized financial institutions. Whether you partner with an analytics firm or start small with internal tools, there are options to fit your budget.

The ROI from better-targeted marketing and customer insights? That’s priceless.

Verdict: Busted!

Cost-effective analytics solutions exist for financial institutions of every size.

Myth #3: “Sharing Data Across Departments is Too Complicated.”

Ever seen Adam Savage try to build a Rube Goldberg machine? That’s what some banks imagine when they think about breaking down internal silos. But in reality, it doesn’t have to be that complicated.

Start by ensuring your marketing, sales, and branch teams are on the same page. Use a single platform or shared reporting to streamline collaboration. Once you see the benefits—like improved campaign results and happier customers—you’ll wonder why you didn’t do it sooner.

Verdict: Busted!

Better teamwork and the right tools make data sharing easier than you think.

Myth #4: “Big Data is Only for Big Banks.”

This myth is like the time MythBusters proved you can fold a piece of paper more than seven times—with the right approach.

If you think big data is reserved for megabanks with endless resources, think again. Community banks and credit unions are in the perfect position to leverage customer data. Why? Because you already have something big banks struggle to achieve: personal relationships with your customers. Combine that with data-driven insights, and you’ve got a winning formula for targeted marketing and strategic engagement.

Verdict: Busted!

Small banks can use data just as effectively—if not more so—than large institutions.

So, How Can Data Drive Growth?

When you let data do the talking, you unlock answers to three crucial questions:

Every Branch Is Unique,

& That's a Good Thing.

Each branch serves a distinct market. Data helps you understand those differences and use them to your advantage. For instance, one branch might thrive on young professionals, while another caters to retirees. By identifying these trends, you can adjust your marketing spend to target the right customers at the right branches.

Real-Life Mythbusting: Targeted Marketing in Action

One financial institution thought they knew how to reach their local Hispanic community: commercials on a specific TV station. But customer data showed that this audience preferred newer television shows and weather programming in the early morning. With this new insight, the institution shifted its marketing strategy and saw a 50% increase in new Hispanic customers.

That’s the power of knowing your audience.

The Data-Driven Advantage

Still not convinced? Consider this: according to Capgemini Consulting, banks that use analytics to guide their decisions have a four-percentage-point lead in market share over those that don’t. That’s a significant edge, especially when budgets are tight, and competition is fierce.

By embracing customer data, you’re not just making better marketing decisions—you’re setting your institution up for long-term success. Data-driven strategies improve response rates, maximize ROI, and give you the confidence to compete in an increasingly digital world.

So, Where Should You Start?

Getting started with data analytics doesn’t require a high-speed camera or a blast-proof testing range. It starts with the basics:

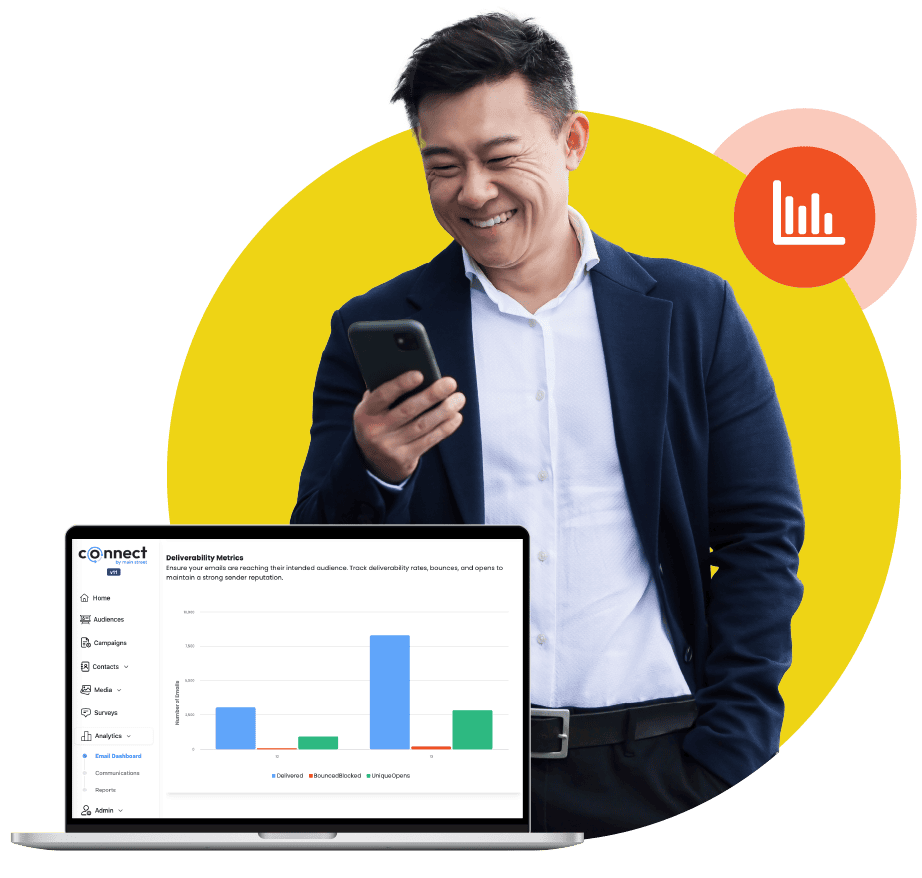

Turn Insights into Action with

Connect by Main Street

You don’t need to be a data scientist to put your customer insights to work. With the right tools, guidance, and strategy, any financial institution—no matter the size—can turn data into growth.

That’s where we come in. At Main Street, we help community banks and credit unions move from gut instinct to precision marketing. Our team doesn’t just talk about analytics—we help you make sense of your data, align your efforts across departments, and execute smarter campaigns.

Our all-in-one marketing and engagement hub, Connect by Main Street, makes it easier than ever to unify your marketing, tap into real-time insights, and drive engagement. Because knowing your customers is just the beginning—knowing what to do with that knowledge is where the real value begins.