Learn How to Segment Data with Connect by Main Street

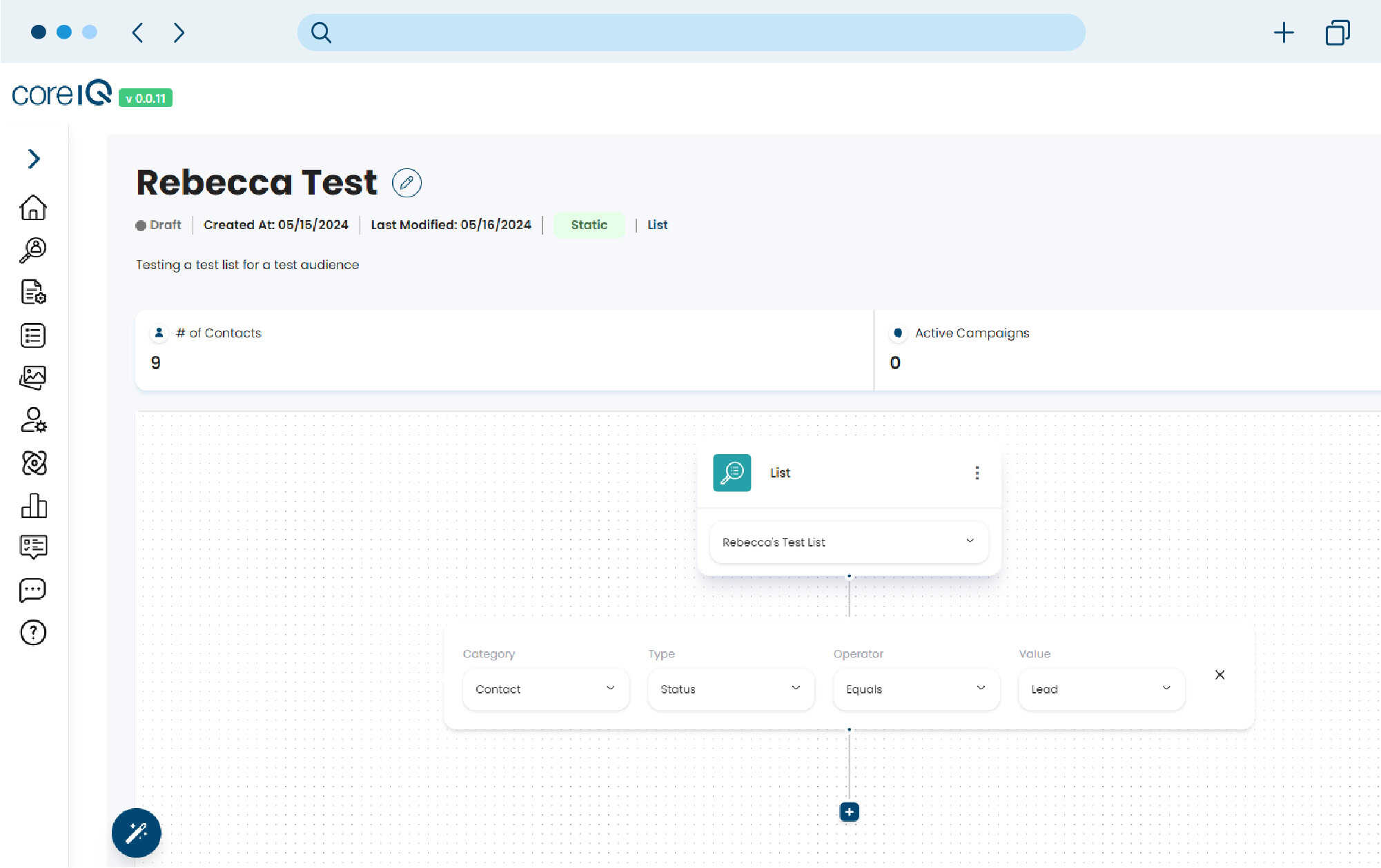

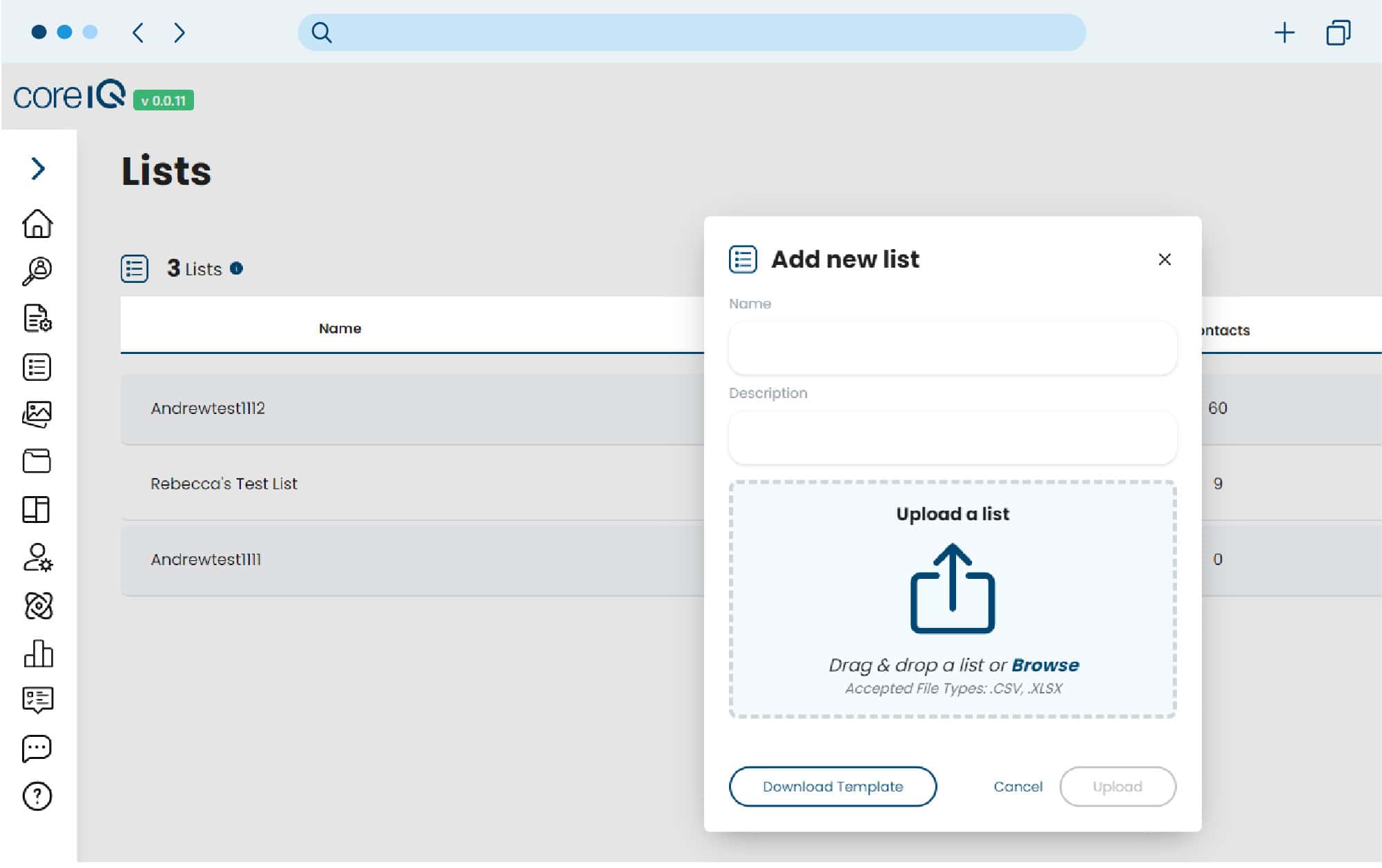

Your community bank or credit union is a treasure trove of high-value consumer data. But accessing and making sense of that information isn’t always easy. That’s why we’ve included data segmentation assistance for all Connect by Main Street users.

We can walk you through the process of uploading, refining, and leveraging data so that you can create targeted lists and precision campaigns. Get started today.

Included Segmentation Assistance

Data Segmentation FAQs

The richest data about your account holders and members comes from your banking core. But Connect doesn’t stop there. You can also upload ancillary and third-party data to enhance your targeted lists and campaign accuracy.

The answer here depends heavily on the nature of your campaign. Depending on what you’re promoting, you might consider age, current account balance, outstanding loans, and dozens of other data points. With a little help, you’ll be making lists in no time.

Yes! Connect turns data into effective communications, but you shouldn’t need deep experience with data segmentation software to use it. We’re all about empowering financial marketers with guidance, support, and pro tips at no extra charge.

Learn How to Segment Data with Connect by Main Street

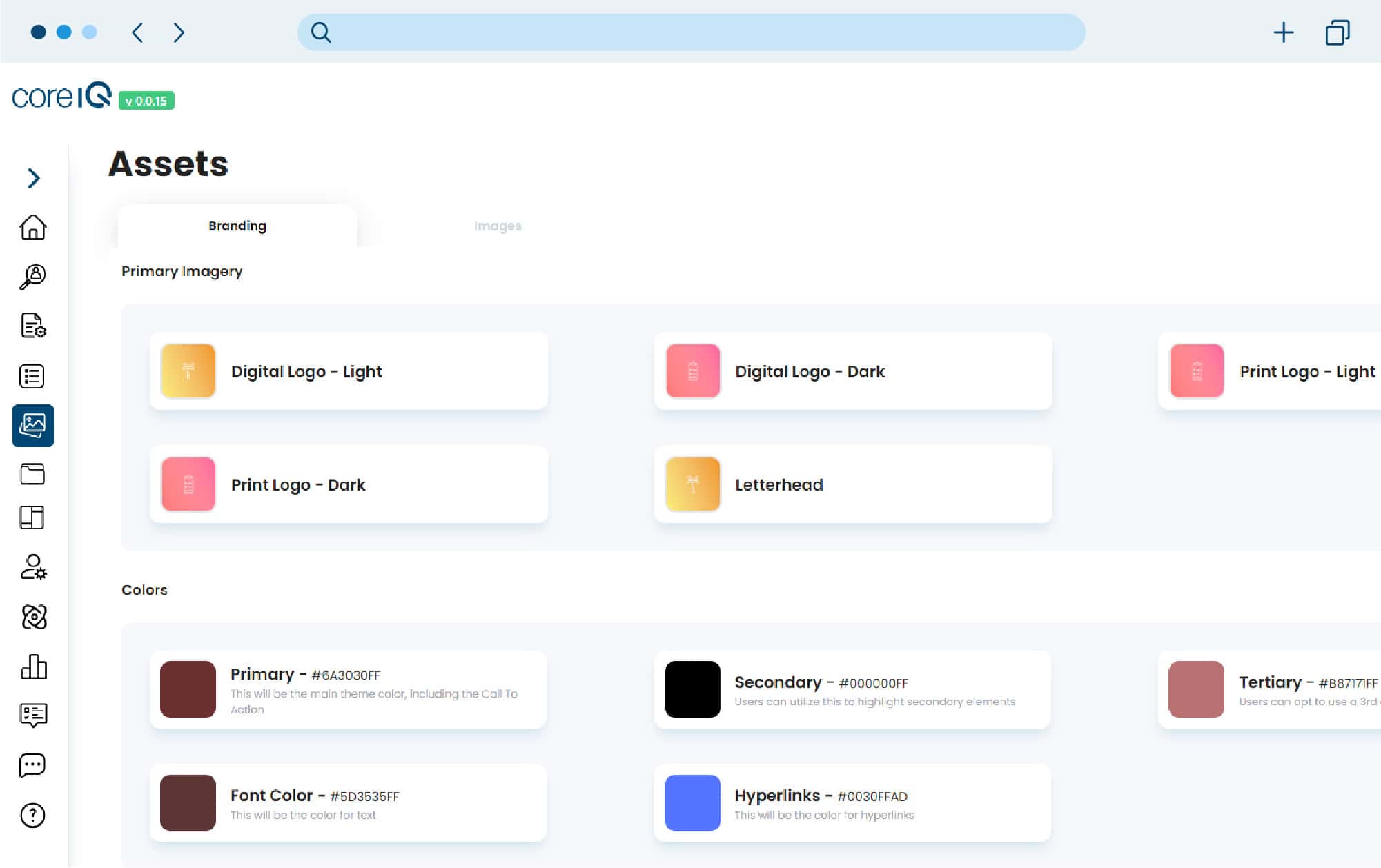

Make the most of your data without bothering IT. Connect by Main Streets puts the power of data segmentation directly into the hands of financial marketers. With Connect, you can make smart and precise campaign decisions from anywhere in the world. Get started today.

Connect with us to learn more about how Main Street helps community financial institutions like yours.

"*" indicates required fields